Connex Credit Union Data Breach Impacts 172,000 Members: What You Need to Know

Connex Credit Union Hit by Major Data Breach: 172,000 Members at Risk

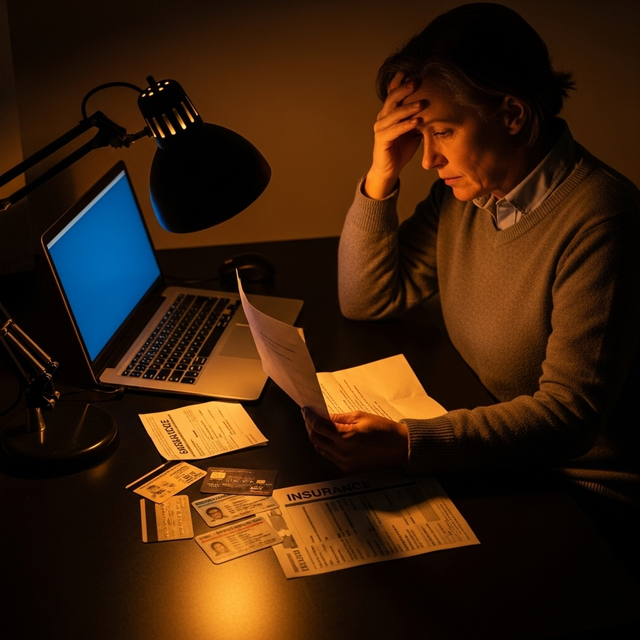

Well, this isn't good. Connex Credit Union just announced they've been hit with a serious data breach that's exposed sensitive information for about 172,000 members. And we're not talking about just email addresses here - we're looking at Social Security numbers, account details, and pretty much everything else you don't want falling into the wrong hands.

I've been tracking these financial sector breaches for a while now, and this one's particularly nasty. Let me break down what happened and what you need to do if you're affected (or even if you're not - because trust me, this won't be the last breach we see).

What Actually Happened

According to Connex's investigation, attackers managed to access their systems between May 6 and May 16, 2023. But here's the kicker - they didn't discover the breach until October 31, 2023. That's nearly six months where criminals had free rein with this data.

The stolen information includes:

Full names

Social Security numbers

Financial account numbers

Payment card information

Driver's license numbers

Online banking credentials

This is exactly why I've been telling everyone I know to use a password manager. If you're using the same password across multiple accounts (and I know many of you are), you're basically handing criminals a skeleton key to your digital life. I personally use NordPass because it makes using unique passwords for every account actually manageable.

Immediate Steps for Connex Members

If you're a Connex member, here's what you need to do right now:

Change your passwords immediately- especially your online banking credentials

Enable two-factor authenticationwherever possible

Place a fraud alertwith the major credit bureaus

Monitor your accountsdaily for suspicious activity

For that extra layer of security, I strongly recommend getting a hardware security key. The YubiKey 5 NFC is what I use - it's basically an "impossible to hack" physical key for your important accounts. Even if someone gets your password, they can't get in without the physical key.

The Bigger Picture: Why This Keeps Happening

This attack bears all the hallmarks of groups like ShinyHunters and Scattered Spider, who've been absolutely hammering financial institutions lately. They're using increasingly sophisticated password-stealing malware and social engineering tactics to breach security.

What's really concerning is how they're targeting password managers built into browsers - you know, the ones that Chrome and Firefox offer to save your passwords. While these are better than using the same password everywhere, they're not as secure as dedicated password managers that use zero-knowledge encryption.

To protect yourself beyond just this breach, I recommend using a VPN when accessing your financial accounts, especially on public WiFi. NordVPN is what I've set up for my family - it encrypts all your traffic so attackers can't intercept your banking credentials.

Looking Forward

The harsh reality is that these breaches are becoming more common, not less. The Connex incident is just the latest in a string of attacks targeting credit unions and smaller banks, which often have less robust security than major banks.

The best defense is to assume your data will eventually be compromised (sorry, but it's true) and set up strong protections now. Use unique passwords everywhere, enable two-factor authentication, and keep a close eye on your accounts.

Quick heads up:Some links in this article are affiliate links. If you buy something through them, we might earn a small commission (doesn't cost you extra). We only recommend stuff we'd actually use ourselves or set up for our own families. No BS recommendations here.